Some Known Details About Why Medicare Advantage Plans Are Bad

Examine This Report on Apply For Medicare

Table of ContentsThe Best Guide To Boomer Benefits ReviewsThe Single Strategy To Use For Medicare Supplement Plans Comparison Chart 2021 PdfFascination About Medicare Part C EligibilityThe smart Trick of Medicare Part G That Nobody is Talking About

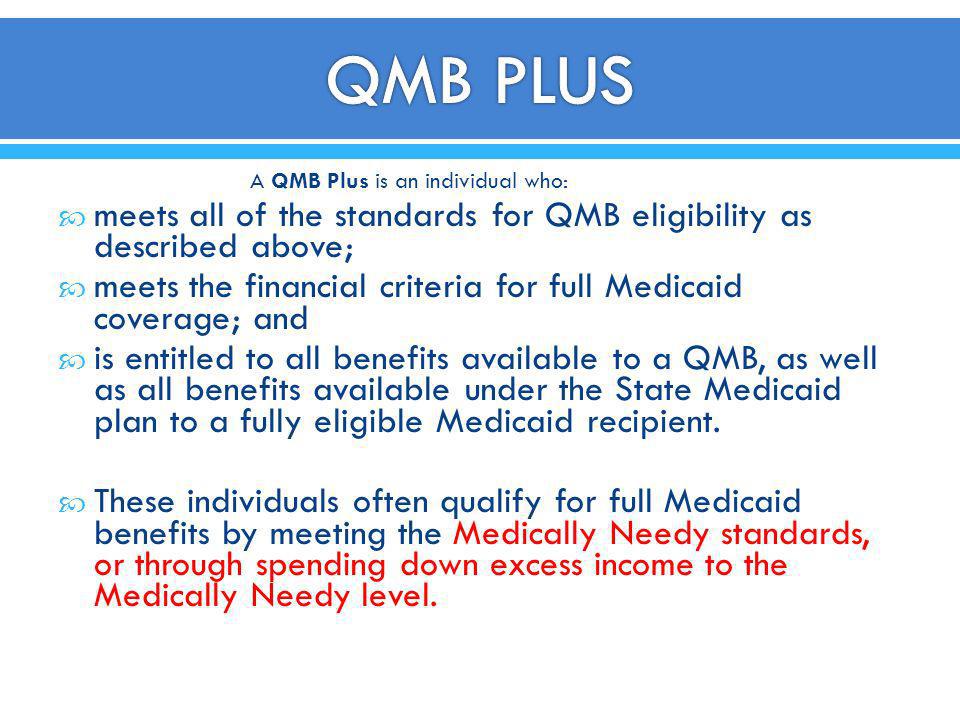

Certified Medicare Beneficiary (QMB) is a Medicaid program for individuals who are currently getting Medicare benefits. The QMB program might differ by state.

Nevertheless, it can likewise be utilized by individuals that live in Assisted Living, Independent Living, or a Group Residence. Similar to all Medicaid programs, QMB has income and possession limits that must be fulfilled in order for somebody to certify for this program. The existing limits for QMB as of January 2022 are: Regular Monthly QMB Limits since January 2022 Gross Revenue Limit Countable Possessions Individual Couple Individual Couple $1,137 $1,538 $7,970 $11,960 The limits are updated quarterly and also can be discovered on the SSI-Related Programs Financial Eligibility Specifications Chart. Benefits of the QMB program include: Medicare Part A & B costs repaid in your Social Safety And Security Examine Medicare Component D costs lowered or covered through the Low Earnings Aid (LIS)/ Bonus Assistance program Drug costs lowered to $0 $10 for most medicines via the LIS/ Bonus Aid program No Donut Hole/ Protection Void Medicare deductibles paid by Medicaid Medicare coinsurance as well as copays within recommended limits paid Here is an instance of just how the QMB program can aid someone: When in the Donut Hole, Insulin can cost $300 each month.

The 10-Minute Rule for Medicare Part G

You can likewise reveal a copy of your Medicare Summary Notice. If you're charged, recommend the company that you're registered in the QMB program. medicare select plans. If you have actually made a settlement while registered in the program, you're entitled to a refund. While QMB is carried out by your state Medicaid agency, it's a separate program from Medicaid and also gives different protection.

It is necessary to know, nonetheless, that specific quantities of income are not counted in figuring out QMB eligibility - how much is medicare part a. Specifically if you are still working as well as most of your revenue comes from your incomes, you might be able to qualify as a QMB also if your total revenue is practically twice the FPG.

If, after applying these regulations, the figure you reach is anywhere near to the QMB qualifying limitation (in 2020, $1,083 in regular monthly countable income for an individual, $1,457 for a pair), it deserves looking for it. (The limits are somewhat higher in Alaska as well as Hawaii.) Possession Purview There is a limitation on the value of the properties you can possess and also still certify as a QMB (medicare select plans).

Because the SLMB and QI programs are for individuals with greater earnings, they have fewer benefits than the QMB program. The SLMB and QI programs pay all or component of the Medicare Part B month-to-month premium, but do not pay any Medicare deductibles or coinsurance look at this now quantities. This implies possible cost savings of more than a thousand dollars per year.

Boomer Benefits Reviews for Beginners

If you are located ineligible for one program, you may still be discovered eligible for among the others. Where to Submit To receive the QMB, SLMB, or QI programs, you must file a created application with the company that manages Medicaid in your stateusually your region's Division of Social Services or Social Welfare Department.

Although a Medicaid qualification employee might require added certain details from you, you will certainly at the very least be able to get the application procedure began if you bring: pay stubs, tax return, Social Safety advantages details, as well as other evidence of your current earnings papers showing all your savings and also other monetary assets, such as bankbooks, insurance coverage, as well as stock certificates car registration documents if you have an auto your Social Security card or number information concerning your spouse's income and different properties, if the two of you cohabit, and also medical bills from the previous 3 months, in addition to clinical records or records to confirm any type of clinical problem that will call for treatment in the close to future.

Ask about the treatment in your state for obtaining a hearing to appeal that decision. At an allure hearing, you will have the ability to provide any kind of papers or other papersproof of income, properties, medical billsthat you assume support your claim. You will certainly likewise be allowed to explain why the Medicaid decision was wrong.

You are allowed to have a pal, loved one, social worker, lawyer, or various other depictive show up with you to help at the hearing. Although the exact treatment for acquiring this hearing, and also the hearing itself, may be slightly different from one state to another, they all resemble really closely the hearings provided to candidates for Social Security benefits.

Not known Factual Statements About Medicare Supplement Plans Comparison Chart 2021

Getting Help With Your Appeal If you are rejected QMB, SLMB, or QI, you may desire to seek advice from with somebody experienced in the based on help you prepare your charm. One location you can find high quality cost-free support with these matters is the nearby office of the State Health Insurance Coverage Aid Program (SHIP).